Six Credit Score Myths Debunked!

Six credit score myths debunked

Could your credit score be the key to a better life?

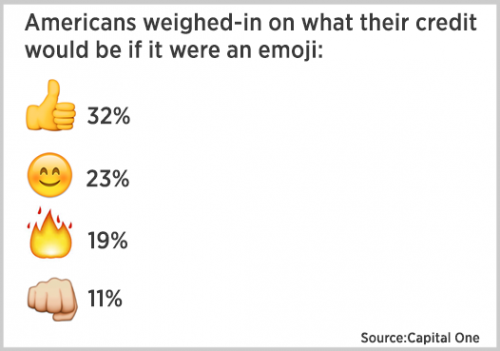

Although 70 percent of consumers said having good credit is the key to unlocking the “American Dream,” they are getting some basic facts wrong, according to Capital One.

More Americans increasingly are aware of the big part their credit score plays in their financial lives, from their ability to get approved for a new charge card, buy or lease a car, rent an apartment and, in particular, determine their mortgage rate. Generally, the higher the score, the better the rate for which consumers will qualify.

“Achieving better credit is core to everyone’s financial health, and this study revealed that there is a strong spirit of optimism; however, there is a need for more education,” said Jennifer Jackson, managing vice president at Capital One.

The financial firm polled more than 2,000 consumers between August and September last year based on their credit history, including those new to credit, those rebuilding their credit and individuals with five or more years of credit experience.

Overall, those surveyed said they would make some significant trade-offs to have better credit. Nearly a third of those polled would rather have “excellent” credit than receive $1 million, and nearly 90 percent of 18-to-24-year-olds would choose “excellent” credit over access to social media.

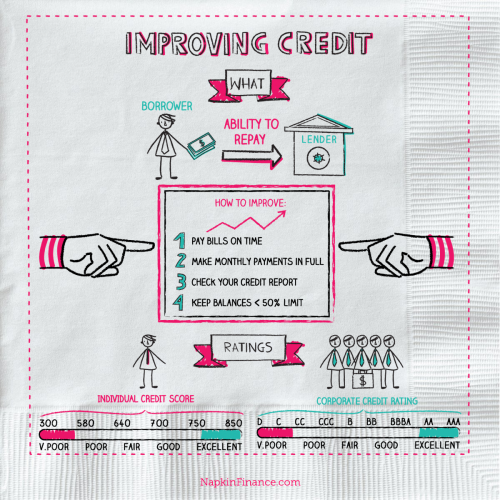

Some scores, notably those from FICO, one of the largest credit-scoring companies, range from 300 to 850. A good credit score generally is above 700, and those over 760 are considered excellent, according to Capital One. Those numbers generally allow you to quality for the best rates.

Even without forgoing Facebook or Instagram, there are simple ways to improve your credit score with a little information. To that end, here are the top misconceptions and the truth behind those three-digit numbers.

Myth: Closing unused card accounts is good for your credit.

Fact: The average age of your accounts is a significant part of your score; keeping your oldest cards open (even if you don’t use them often) generally will help your score.

Myth: Paying your utility or cell phone bills on time builds your score.

Fact: Not really. On the other hand, if you are late or delinquent that will hurt you.

Myth: Holding a credit-card balance is good for your credit.

Fact: Generally it’s better to pay your credit card bill in full and on-time every month. (Plus, that way, you avoid interest charges.)

Myth: There is only one credit score. (Nearly 29 percent thought so.)

Fact: There are multiple credit-scoring models used by multiple credit-scoring companies. Your score can even change depending on the type of loan you are seeking.

Myth: While more than half of consumers know that checking your credit report will not reduce your credit score, 27 percent said it will.

Fact: A so-called hard inquiry for credit-card applications or credit checks for loans can cause a temporary dip in your score. Soft inquiries such as reviewing your credit score through credit-monitoring tools will not impact your score. (Surprise! Frequent credit score checks improve it.)